Momentum: A Source for Sparking Trade Ideas

Learn how this physics concept can be used to generate trade ideas

Thank you for reading!

“Trade by Trade” isn’t a service but a personal project to help you on your trading journey and keep me accountable with mine.

For a full description of what this publication is and who I am, see here.

This week, we’ll explore using momentum as a source for generating trade ideas.

Last year, I took an online course from a former Big 4 professional trader.

During one lecture, he shared something that has been crucial to my understanding of managing my own book.

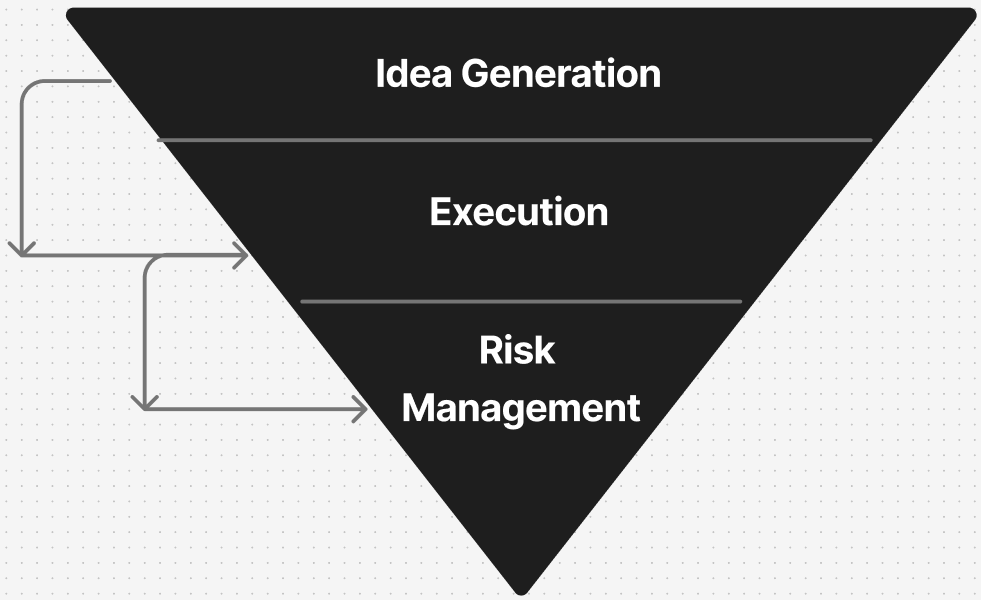

Trade ideas are the lifeblood of your portfolio.

Even with perfect risk management or rock-solid psychology, having poor ideas can result in poor PnL. Everything stems from idea generation.

I look at it like funnel—where everything flows from the top.

It’s imperative to have a reliable system for generating quality trade ideas. Here’s the key:

systematic > random

The world’s top traders and funds don’t rely on hunches or gut feelings - they follow a process. Here's how some of them do it:

Bridgewater Associates: Ray Dalio’s systematic global macro approach generates alpha through data-driven decisions

Paul Tudor Jones: Incorporates technical analysis into his global macro trading

Renaissance Technologies: Jim Simons’ fund that uses pure mathematical modeling to generate ideas

Elliott Management: Paul Singer’s combined approach of activist investing and deep fundamental analysis to uncover mispricing

While approaches vary, notice that one truth remains constant: successful professionals follow a systematic process to generate trade ideas.

I hope you pick up what I’m putting down here.

This begs to ask the question…

What will your process be?

Let’s dive into one of Wall Street’s most powerful anomalies and how you can use it to generate ideas.

Momentum: the background

Newton’s first law states that “an object in motion tends to stay in motion.” This principle doesn’t just apply to physics but markets too.

Isn’t that cool?!

In markets, momentum measures an asset’s performance over time. This is what traders mean when they say "trade with the trend" - they're following momentum.

The overall concept of momentum is to buy stocks that have performed well with the expectation that they will continue to do well. This is a popular framework for generating ideas because:

it’s simple to understand

easy to implement

sounds logical

In fact, many successful traders have quotes pertaining to momentum. Here’s one by Ed Seykota…

“The trend is your friend until the end when it bends.”

Or this one from Paul Tudor Jones…

“I don’t buy anything that isn’t going up.”

How about everyone’s beloved favorite, Stan Weinstein…

“Don’t fight the tape—go with the trend.”

Of course, I cherry picked these as examples but you’d be surprised at how often successful traders allude to momentum (trend). This is all well and good…

…but does momentum actually work?

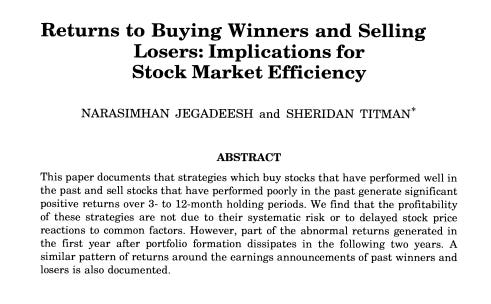

There’s a very popular academic paper that explores this anomaly.

It was written in 1993, by Jegadeesh and Titman, and it challenged the efficient market hypothesis (EMH) which was widely believed in that that time of finance.

EMH is still a popular theory, in fact I was taught it at University, and it states that stock prices reflect all public and private information.

It’s a very interesting theory, and even if you don’t believe it, I still encourage you to give it a read.

Momentum was a game-changing discovery.

Jegadeesh and Titman’s groundbreaking paper, Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency, revealed something remarkable:

“...strategies which buy stocks that have performed well in the past and sell stocks that have performed poorly in the past generate significant positive returns over 3- to 12-month holding periods."

This is great news for the average retail trader like you and me.

Momentum isn't magic or speculation. It's a statistical, quantifiable edge that exists in markets and will likely persist.

Using momentum: theory to practice

You can screen for assets that are in an uptrend (for longs) and build from there.

What counts an “uptrend?” Great question, there are two major ways to do so.

1. Moving Averages

Many traders swear by moving averages (20, 50, and 200-day are the most popular ones). If the slope’s up, the asset is in an uptrend.

Here’s gold with a 20-day moving average (blue line):

Moving averages are not my preferred way of measuring trend but my friend,

, has recently published an excellent post about using moving averages!2. Raw Performance

This method uses a raw performance score over a specific period to determine positive or negative momentum: “is stock $XYZ positive or negative on a 6-month lookback?”

I prefer this approach because it's simple and has the most research backing it.

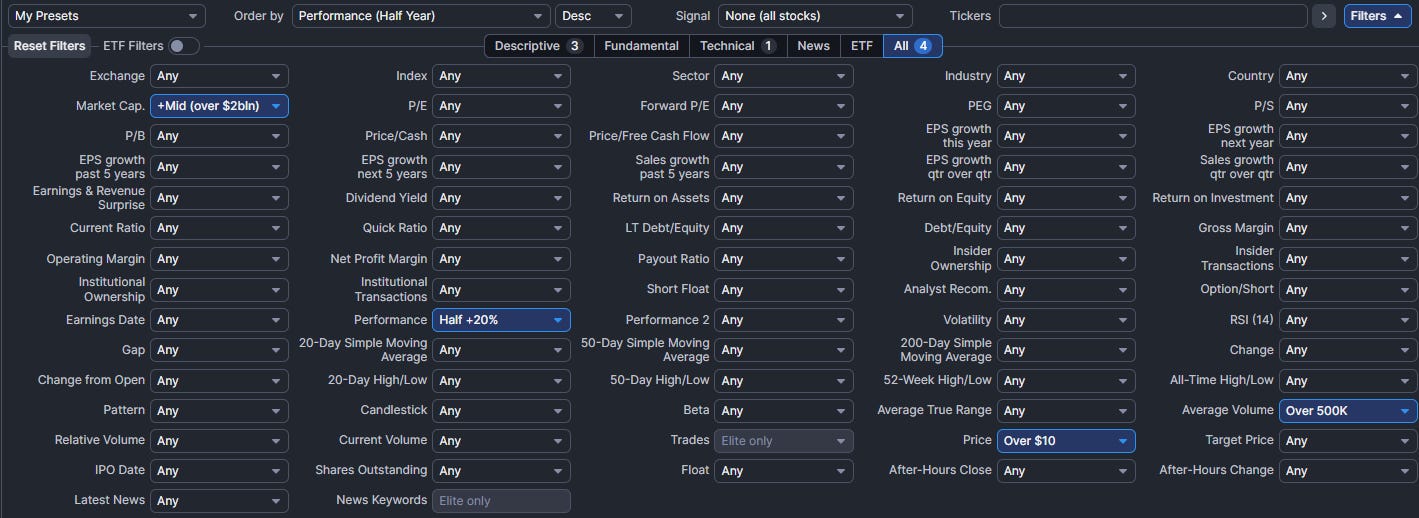

Whatever method you choose, there's a tool that makes momentum screening easier: Finviz.

Here’s a simple screen for finding stocks with momentum. It filters for:

mid-cap + (stocks over $2 billion in market cap)

liquid (over 500k in average volume)

not a penny stock (over $10/share)

momentum (up 20% in 6 months)

Screening is just the first step.

In my university investment class, we never picked stocks based on just one or two factors. We used a comprehensive "weight of the evidence" approach.

You’ll want to dig deeper, (whether that means examining the business model, reviewing fundamentals, etc.) but this gives you a solid foundation for generating trade ideas.

A common rebuttal to momentum is…

“Well this stock has already gone up so much, it can’t keep going.”

This belief is widespread among new traders and even professional asset managers.

But it contradicts the whole essence of momentum and it could really make you miss out on some great trades!

Take Nvidia, for example. If you avoided this stock after its 350% rise in 12 months, you missed an additional 200% gain in just 6 months.

If you had no exposure to NVDA, you probably didn’t receive a bonus—or worse, you lost your job.

While this is an extreme case (and these moves are rare), they do happen. A stock is trading at new high’s for a reason!

Let’s talk risk

With anything in markets, there is no free lunch.

Momentum comes with a big risk: when it shifts.

That is when the market suddenly favors underperforming stocks over recent winners.

You can see how this can be problematic, right?

If you're portfolio is heavily positioned in high-momentum stocks, these shifts can lead to significant underperformance and drawdowns. The worst part about it…

…you can’t predict when momentum shifts happen.

At least, I can’t.

Let’s look at a current market example.

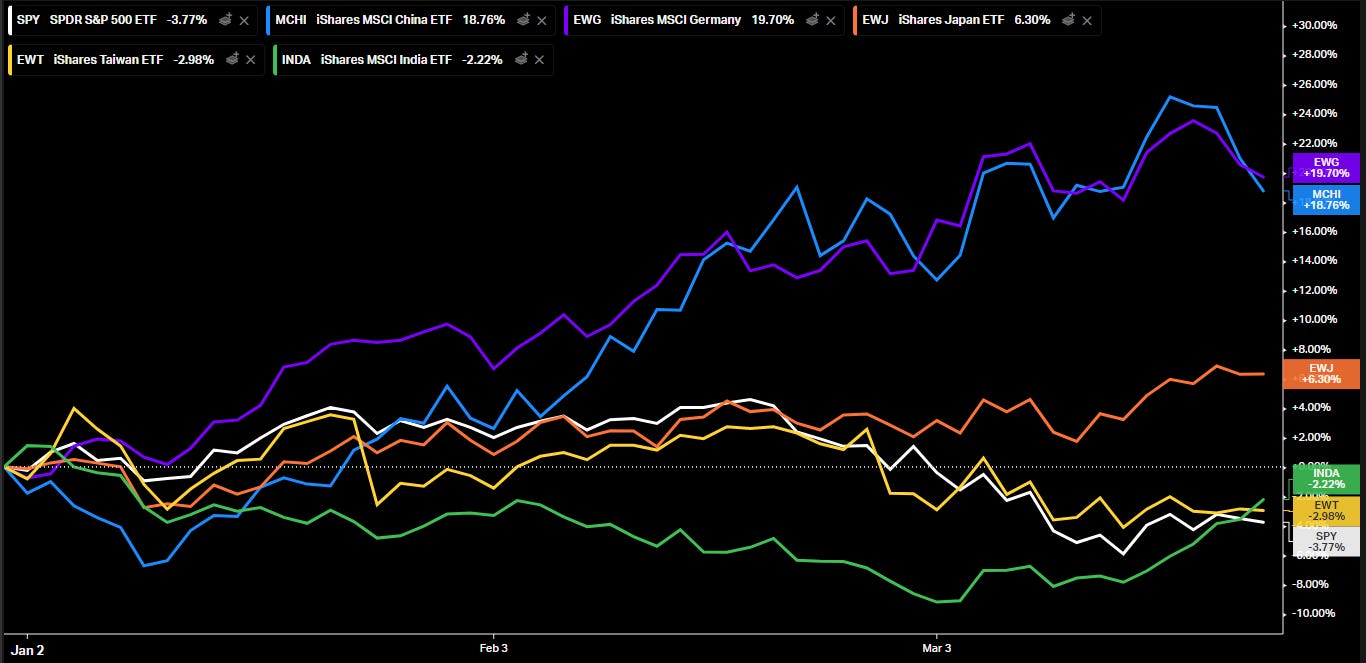

The S&P 500 is down over 3% year to date, with an 8% decline from its peak. Despite the volatility in U.S. equities, other countries are not experiencing this same heat.

Look at how the U.S. (white line) as performed against other countries year to date:

Whether this downturn stems from economic concerns, tariff issues, or other factors is unclear and, frankly, indifferent to me.

The point is if you’ve been looking at the U.S. only, trades have been hard to find.

If you are going to trade momentum, you have to be on top of market moves.

In order to use momentum as a source for idea generation…

you have to be up to date with the latest market trends and know what’s going on ALL THE TIME…EVERYWHERE.

Just kidding.

You don’t have to be that extreme. Simply reading headlines and spending thirty minutes every morning checking the news will suffice. If something is interesting, look into it—otherwise, move on.

Here are three of my favorite sites that I use everyday and are not behind a paywall:

You can also use performance data on market sectors or specific country ETFs to see what’s going on. I I talked more about this in week four’s publication.

Wrapping up: use momentum as a source of idea generation

Momentum isn’t a made up thing— it’s a proven, systematic way to spark trade ideas. From Jegadeesh and Titman’s 1993 bombshell to today’s evidence, the data is clear: buying winners works.

So, here’s your edge:

use momentum as a source to find ideas.

Realize that it’s not the only way to generate trades but it is one of many, proven methods.

Tools like Finviz, make it simple to screen for these opportunities.

Sure, shifts happen, and markets can be unpredictable—but that’s why you pair momentum with a broader process.

That’s it for this week’s post. Have a good rest of your weekend,

- R

Thank you for reading. If you enjoyed the content, could you do me a favor?

Please consider sharing this publication and tapping the ❤️ button—it’ll help others see the true side of trading, straight from someone navigating wins, losses, and lessons.

Disclaimer: The content shared on “Trade by Trade” is for educational and informational purposes only. Nothing published here should be considered investment, trading, or financial advice. The views expressed are solely my own and do not represent those of any institution or entity. Trading and investing involve significant risks, including the potential loss of capital. You should conduct your own due diligence and consult with a qualified financial professional before making any investment or trading decisions. By engaging with this content, you acknowledge and accept full responsibility for your financial choices.